|

|

|

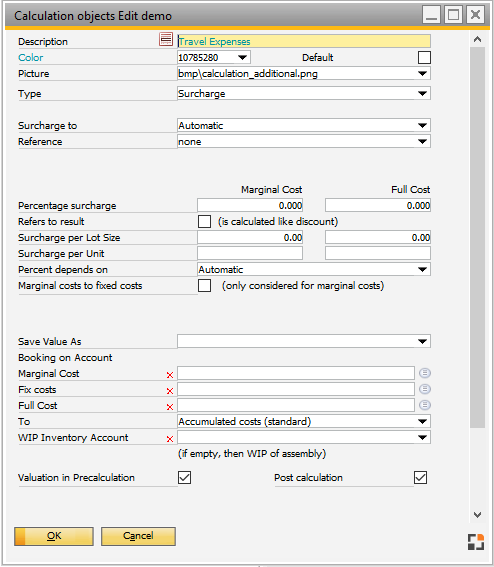

Description

|

Description

|

Color

|

Objects of different areas have the following colors

Light blue: defined calculation objects (RGB 10785280)

Red: Subtotal of the above objects (RGB 4793544)

Blue: Sales price and revenue (RGB 11941650)

Colors can be adapted individually.

|

Image

|

This image is used to represent the object in all lists

|

Type

|

|

|

|

Surcharge

|

Surcharge object: arbitrary surcharge as value or per cent or cost type

see cost element

|

Material sum

|

Pure sum field: represents the material costs including outsourced operation costs.

|

Production sum

|

Pure sum field: Represents the sum of manufacturing costs

|

L + M costs

|

Pure sum field: sum of all material, production and surcharge costs calculated up to this position

|

Sales price acc. to entry

|

Represents the sales price. Option "Sales price according to default": if you don´t enter a sales price, the calculated gross full costs or gross marginal costs are used.

|

Margin amount

|

Represents the margin

|

Margin %

|

Represents the margin in %

|

Margin (hr)

|

Represents the margin per hour

|

Material costs without outsourced operation

|

Pure sum field: represents the material costs without outsourced operation costs.

|

Cost of External Operation

|

Pure sum field: represents the external operation costs

|

|

|

Surcharge to

|

Charge to" can only be configured in the "Total Cost Field" object type

|

|

|

Material Costs

|

Charge to material costs

|

Non Material Mfg Cost

|

Charge to manufacturing costs

|

Production Cost

|

Charge to production costs

|

Cost of Sales

|

Charge to cost of sales

|

Net Sales Price

|

Charge to net sales price

|

Gross Sales Price

|

Charge to gross sales price

|

Price from Offer

|

Charge to price from offer

|

Basic Material Costs

|

Charge to source material costs

|

Automatic

|

Automatic calculation (preferred setting)

|

|

|

Reference

|

"Reference" can only be configured in the "Total Cost Field" object type

|

|

|

Loading for material

|

Material surcharge costs (surcharges are defined in the material group of the material).

|

Cost of tools

|

Tool costs (currently can only be determined via cost element) – see Tool.

|

No

|

Manual input of surcharges as amount and / or percent at marginal and full costs.

|

Material price as per BOM

|

Material costs without external operation costs.

|

Non Material Mfg Cost for WO Stat.

|

Non Material Manufacturing Cost.

|

cost of External Operation

|

Cost of External Operation.

|

Net weight

|

Weight surcharge calculation at net weight (does not currently work).

|

Gross weight

|

Weight surcharge calculation at gross weight (does not currently work).

|

Calculated Shipping Costs

|

Shipping cost calculation (does not currently work)

|

Cost element

|

Sum of the cost element to be defined here. This can be used to perform an analysis for setup, processing, tool costs, wage costs, etc.)

see cost elements, tool costs.

|

Cost element surcharge

|

Surcharge sum of the cost element to be defined here. The surcharges are defined in Master data > Cost element .

|

Cost element group

|

Sum of cost element group (sum of all cost elements in this group).

|

Cost group surcharge

|

Sum of cost element group (sum of all cost elements in this group).

|

Script

|

surcharge is calculated with a script. A script management is available, which can be called up via selection feature in this field See Scripting.

|

|

|

Cost element

|

For reference "Cost element" and "Cost element surcharge" only - Determines which cost element sum should be considered.

|

Time requirement display

|

For reference "Cost element" only - should the time requirement planned for this cost element be displayed in the calculation (visually only)

|

Cost element group

|

For reference "Cost element group" and "Cost element group surcharge" only – determines which cost element group sum should be considered.

|

Script

|

For reference "Script" – Determines, which script to use for surcharge calculation. See Scripting, Scripting Precalculation, Scripting Post-calculation

|

% Surcharge

|

Only visible for reference "None": determines the percentage value of the surcharge at marginal and full costs

|

Surcharge per lot size

|

Precalculation

Value refers to lot size of the item to be calculated. If the item has no lot size, the calculation lot size applies.

Example:

Lot size: 10

Surcharge per: 5€ (in this case per 10)

View per: 100

Displayed: 50€ for 100

Production Price calculation

Lot size depends on valuation method

Example: Price per Lot size = 100€, Work order: 10 Pcs

Calculation for plan costs: Projection is always on

Example: Receipt same quantity as planned

Receipt Qty

|

Close

|

Projection off

|

Sum (*1)

|

Projection On (*2)

|

Sum *1)

|

2

|

|

100€

|

100€

|

Lot size price 100€ / 10 Total Qty * 2 Receipt Qty) = 20€

|

20€

|

3

|

|

0

|

100€

|

30€

|

50€

|

5

|

x

|

0

|

100€

|

100€ - previous total (50 € ) = 50€

|

100€

|

(*1) Valuation type Post calculation: The system calculate always the complete sum (Accumulated) and divide at end all previous costs

(*2) Valuation type Plan calculation: Always use "Projection on". Always calculate per receipt quantity.

Example: Receipt less than planned

Receipt Qty

|

Close

|

Projection off

|

Sum (*1)

|

Projection On (*2)

|

Sum *1)

|

2

|

|

100€

|

100€

|

Lot size price 100€ / 10 Total Qty * 2 Receipt Qty) = 20€

|

20€

|

3

|

|

0

|

100€

|

30€

|

50€

|

1

|

x

|

0

|

100€

|

100€ - previous total (50 € ) = 50€

|

100€

|

Example: Receipt more than planned

Receipt Qty

|

Close

|

Projection off

|

Sum (*1)

|

Projection On (*2)

|

Sum *1)

|

2

|

|

100€

|

100€

|

Lot size price 100€ / 10 Total Qty * 2 Receipt Qty) = 20€

|

20€

|

3

|

|

0

|

100€

|

30€

|

50€

|

10

|

x

|

0

|

100€

|

100€ - previous total (50 € ) = 50€

|

100€

|

|

|

Surcharge per unit

|

This is to define surcharge per unit.

Precalculation

Lot size given in Precalculation

Production post-calculation

Planned value: quantity as per manufacturing position quantity in warehouse units

Actual value: total posted quantity

|

Assembly valuation

Partial posting / Calculation object: quantity to be posted in

Partial posting / Summation: already posted + quantity to be posted in

Final posting / Calculation object: quantity to be posted in

Final posting / Summation: already posted + quantity to be posted in

Note on valuation at planned costs:

Only the posted quantity is valued, not the planned quantity.

At final valuation (upon closing the work order) the total planned quantity is taken as reference.

Example 1:

Surcharge per unit: 5 €

1. Partial posting 2 pieces: 10€ on object, 10€ in sum

2. Partial posting 2 pieces: 10€ on object, 20€ in sum

Because an account can be stored in calculation object, it is mandatory to calculate costs for posting.

|

|

Percentage value relates to

|

only visible for reference "None". Defines the sum to which the percentage value refers

Automatic

|

Refers to the last sum, if no intermediate sum is there, as reference serves the first entry, which returns a value

|

Price of material as per BOM

|

Refers to the material sum

|

Non Material Mfg Cost for WO Stat.

|

Refers to the manufacturing costs

|

cost of External Operation

|

Refers to the external operation costs

|

Material costs + external operation costs

|

Refers to the sum of the material costs and external operation costs

|

|

Save value as

|

The costing analysis includes 6 user-definable fields in which the calculated costs can be saved.

This makes it easier to further utilize the costing analysis.

The following values are fixed:

Material surcharge

Production surcharge

(Values saved here are user-definable)

4 further fields can be defined in the Configuration Wizard.

The values stored there can be retrieved directly in the results list in the costing analysis (e.g. wage costs, tool costs, machinery costs)

|

Booking on account (marginal costs, fixed costs, full costs)

|

If an account is stored here and in the Configuration wizard > Production > Valuation Assembly > Valuation > Post overheads for partial delivery is NOT set to "No posting" and continual inventory maintenance is activated, the accounts specified here are credited and the WIP account debited at the time indicated there.

The cost rate at marginal costs, fixed costs (= full costs - marginal costs) or full costs can be used.

|

To ...

|

Refers to the account to be debited:

Defines the amount to be posted:

Accumulated costs

|

The actually accumulated costs are posted (actual value)

|

planned costs

|

The planned costs as per precalculation are posted

|

planned for partial delivery, other accumulated

|

Can only be used if posting of overheads to "For assembly receipt" is activated.

For partial delivery, the planned value (target value) is posted, otherwise the accumulated costs (actual value).

|

Note:

The surcharge postings are made to the planned costs if an evaluation of the assembly postings are made to planned costs.

A mixture of planned-evaluation with surcharges to accumulated cost is not possible.

This means that this setting is set to "planned costs" when a posting to planned costs is made.

(beas 9.3-000)

|

|

WIP inventory account

|

If the amount is not posted to the WIP inventory account of the assembly to be produced, the WIP account to which postings are made can be defined here.

Option is only visible if in SAP > Administration > System Initialization > Document Setting > Per Document > "Production Order" "Component WIP Accounts" is activated.

|

Valuation in precalculation

|

If deactivated, the object is displayed in the precalculation but not valued.

|

Valuation in costing analysis

|

If deactivated, the object is NOT displayed in the precalculation and also not valued.

|

Refers to result

|

Determines whether the % value relates to the previous sum or to the reference sum (A) or to the reference sum + addition to be calculated. (B)

(similar to calculation of discount or revenue)

Example: Switch deactivated, reference is A(100€) first sum

100 €+10% of A(10€) = 110

Example: Switch activated, reference is B(110€) second sum

99€+10% of B(€ 11) € 110 = 110

|

|

marginal costs to fixed costs

|

The fixed cost surcharge determined in calculation of marginal costs is added to marginal costs.

Example: The fixed cost share of the labor costs shall be added at marginal costs calculation.

Reference = manually

Surcharge per cent = 100% for marginal and full costs

Per cent refers to production costs according to the working sequence

At marginal costs to fixed costs: activate

Production costs would be 60 (marginal costs) or 80 (full costs)

At marginal costs calculation the 20 (100% full costs -100% marginal costs = the full fixed costs) are added up.

|

Post calculation

|

If this radio box is selected, this calculation object is considered in Post calculation.

|