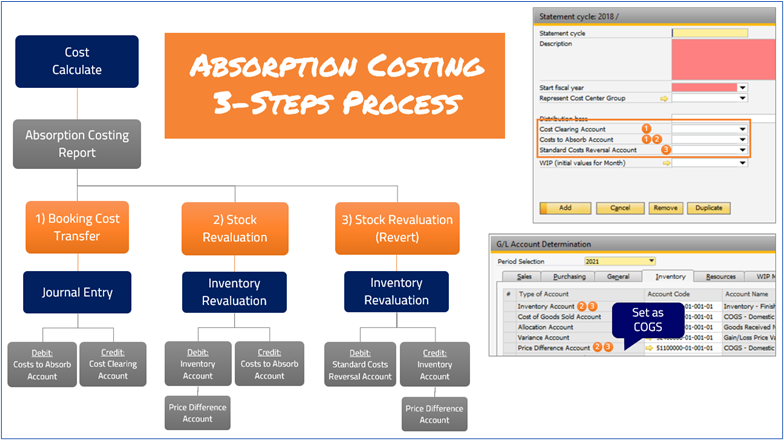

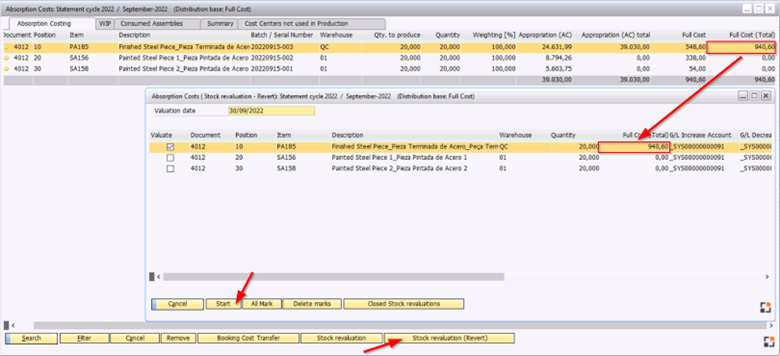

After completing the verifications and making sure that all data is correct (if not, please fix everything before going forward), you can proceed to execute absorption costing. Executing it requires three major steps, illustrated in the image below and explained further in this topic. The circled numbers represent the accounts used in each step.

Important notes:

•After the absorption costing processes of Stock Revaluation and Stock Revaluation (Revert) are executed for a Statement Cycle, they cannot be performed for the same Work Orders again. Be sure that all values are correct before starting the three major steps.

•There is no cancellation option for the absorption costing process. Whenever absorption costing transactions need to be reverted, you must create new inverted Stock Revaluations in SAP (manually or using DTW) to correct the values. Stock Revaluations created manually or using DTW will not display on the Absorption Costing report.

•Due to an SAP Business One’s limitation, the Stock Revaluation transactions can only be done considering the stock available at the moment in which they are being executed. As the available stock influences how much of the values will go into stock or COGS accounts, it is recommended to execute the Absorption Costing process as soon as possible after the month ends.

NOTE: Screenshots in this chapter are made with the "Old System (Deprecated) style" set in the Configuration wizard.

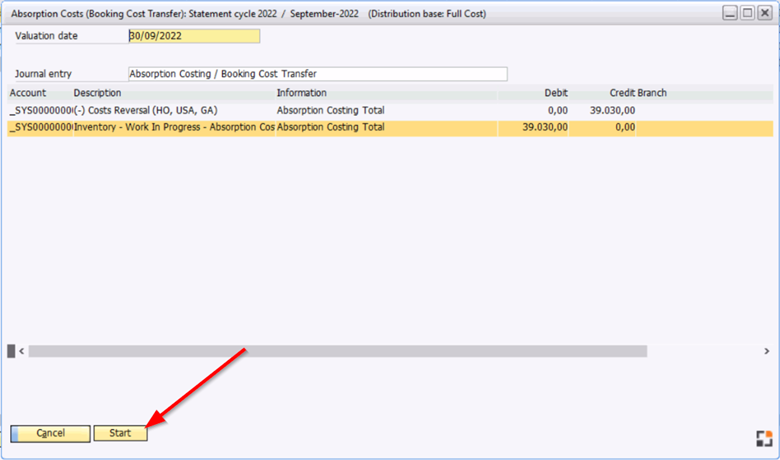

1)Execute Booking Cost Transfer. Whenever you book manufacturing costs in SAP Business One, being them related to labor or overheads, they will go to costs or expenses accounts and be part of your Profit and Losses Statement. Using absorption costing, however, those costs only affect your Profit and Losses Statement in the form of COGS after the products are sold. In this first step, all your manufacturing-related costs are credited from the “Cost Clearing Account” (expenses contra account) and debited to the “Costs to Absorb Account” (asset account) set in the Statement Cycle.

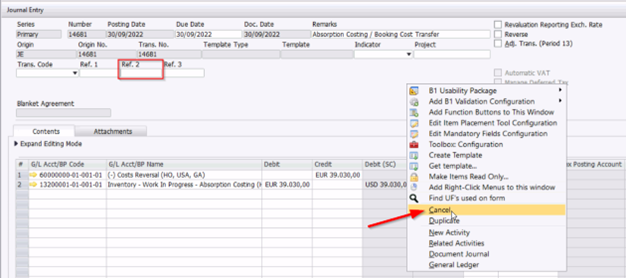

Important note: This is the only step with a relatively easy cancellation procedure if you detect a mistake in your absorption costing process. Therefore, make sure everything is correct before proceeding. If you ever need to cancel a Booking Cost Transfer process, follow these steps:

Open the Booking Cost Transfer journal entry, erase the content of “Ref. 2”, update and then cancel it using the same posting date as the date in which Booking Cost Transfer was originally posted. This will enable you to perform Booking Cost Transfer again.

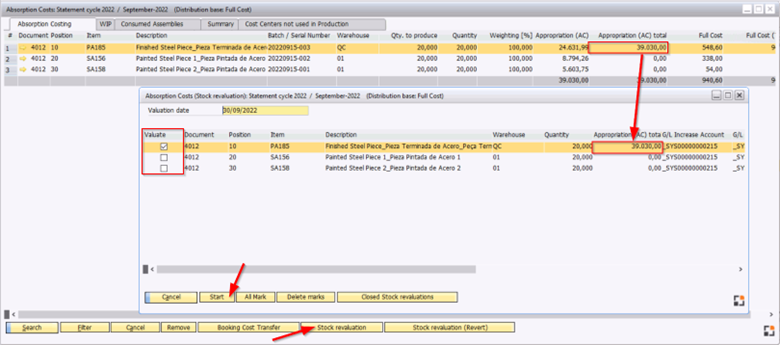

2)Execute Stock Revaluation. This is the moment in which Beas really appropriates costs into the products, taking values from the “Costs to Absorb Account” and moving those values either to the products’ stock accounts or COGS (if there is not enough stock during the revaluation). If there are any products for which you don’t want to appropriate values now, you can deselect the “Valuate” column, and they will remain open in the list after you run the Stock Revaluation step. This column is automatically selected for items with values to appropriate and deselected for items with 0 appropriation value.

Here is a summary of SAP’s possible bookings for the Stock Revaluation process:

Reevaluation Amount |

Reevaluation Quantity |

Quantity in Stock |

Stock Variation |

COGS Variation |

+1.000,00 |

100 |

100 |

+1.000,00 |

0,00 |

+1.000,00 |

100 |

50 |

+500,00 |

+500,00 |

+1.000,00 |

100 |

0 |

0,00 |

+1.000,00 |

Important note: There is no cancellation option in SAP Business One for Stock Revaluations. If you ever need to cancel an absorption costing process, you can only do so by performing opposite revaluations through DTW.

3)Execute Stock Revaluation (Revert). This is not an optional step. You must execute Stock Revaluation (Revert) in order to complete the absorption costing process. This step removes from the manufactured products the costs added during the Beas’s manufacturing products using the resources’ cost rates. These costs are useful to keep the costs as close as possible to the costs after running absorption costing, but cannot remain afterwards, or products will have double costing.

Here is a summary of SAP’s possible bookings for the Stock Revaluation (Revert) process:

Reevaluation Amount |

Reevaluation Quantity |

Quantity in Stock |

Stock Variation |

COGS Variation |

+1.000,00 |

100 |

100 |

+1.000,00 |

0,00 |

+1.000,00 |

100 |

50 |

+500,00 |

+500,00 |

+1.000,00 |

100 |

0 |

0,00 |

+1.000,00 |

Important note: There is no cancellation option in SAP Business One for Stock Revaluations. If you ever need to cancel an absorption costing process, you can only do so by performing opposite revaluations through DTW.

see Absorption costing - Finishing steps