The Statement Cycles are a mandatory master data for Business Performance and have a similar logic to Posting Periods in SAP, except that they are always annual and, when working on multi-branch databases, have to be branch-specific. Here is how to create them.

NOTE: Screenshots in this chapter are made with the "Old System (Deprecated) style" set in the Configuration wizard.

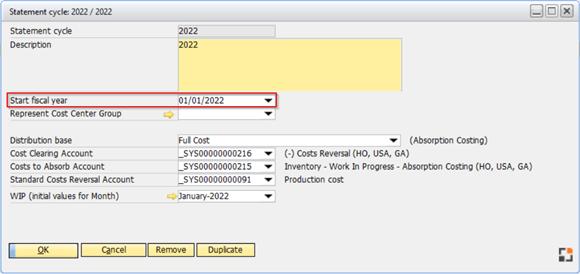

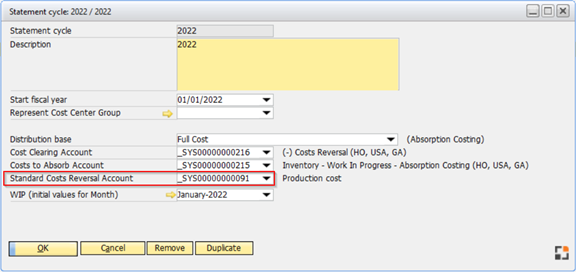

1) Create a Statement Cycle, define starting date for the year and set the related branch (only if using multi-branch):

Window bab_abrid_edit.psr

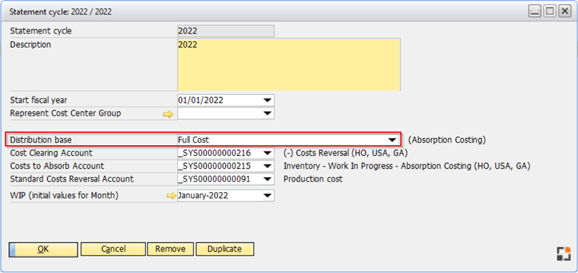

2) Set the Distribution Base for absorption costing. The Distribution Base defines how the costs coming from direct Cost Centers (after all distributions are processed) should be carried over into the manufactured products. Distributions can happen either based on production hours, on marginal costs, or on full costs. It is recommended to always use marginal or full costs to base absorption costing distribution, as they represent the multiplication between production hours and the resource cost rates (which are set to represent the average costs per minute or hour for each machine or work center). If only using hours, products going through inexpensive resources for a large number of hours will receive more costs than products going through very expensive resources for a small number of hours.

Window bab_abrid_edit.psr

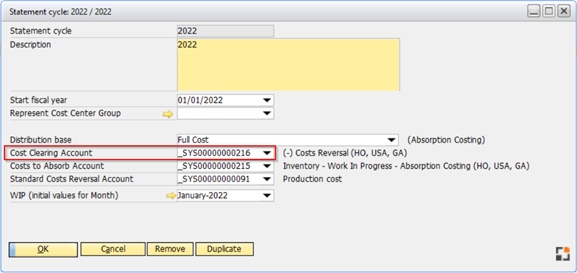

3) Set the Cost Clearing Account for absorption costing. This is a contra account to all manufacturing expenses (except direct materials, as direct materials are always directly appropriated into the manufactured products and are never part of an absorption costing process), turning their total amount to 0 after executing the first absorption costing step, called “Booking Cost Transfer”. You can create this account in your Chart of Accounts just below the accounts related to direct labor and manufacturing overheads. This account will receive a credit value.

Window bab_abrid_edit.psr

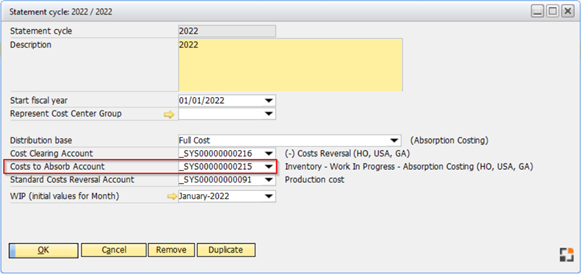

4) Set the Costs to Absorb Account for absorption costing. This asset account offsets the Cost Clearing Account by receiving a debit value during the first absorption costing step, called “Booking Cost Transfer”, holding the total amount of costs to absorb during absorption costing execution. Its nature is similar to a work-in-progress account, as it represents inventory-to-be.

Window bab_abrid_edit.psr

5) Set the Standard Costs Reversal Account. Throughout the month, when manufacturing goods, Beas assigns manufacturing costs to products according to the cost rates of resources, which are set in a way to represent historical average costs per hour or minute but will never match exactly the actual manufacturing expenses. While helpful in minimizing differences between before and after absorption product costing, these costs cannot remain on the products after absorption costing, or the products will have duplicated costs (one calculated based on the resource rates and another coming from absorption costing). This field defines in which account the reverted values coming from costs calculated based on resource costs rates should be booked and is a contra account to the accounts set in the Beas Calculation Schemas or Production Cost Elements.

Window bab_abrid_edit.psr

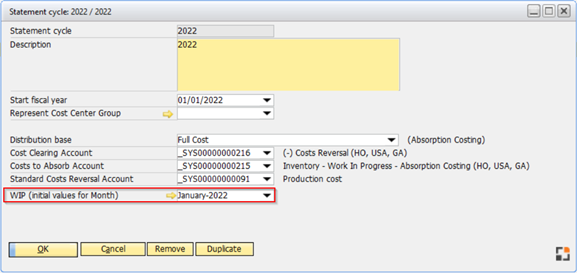

6) If there are open values from previous absorption costing processes before implementing Beas Manufacturing, you can set the initial values under “WIP (initial values for Month)” (by clicking on the golden arrow) and define for which month they should apply.

Window bab_abrid_edit.psr

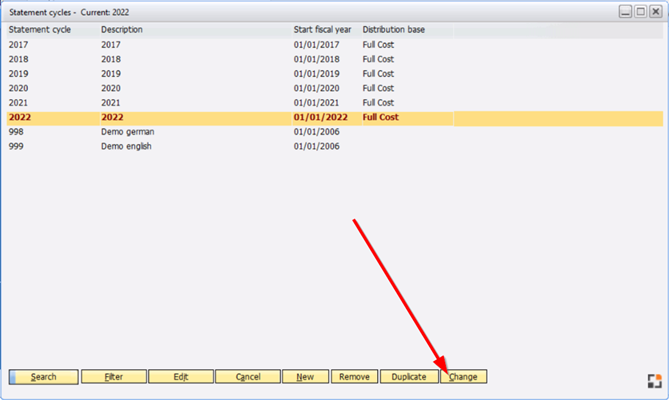

7) The last step, after creating the Statement Cycles, is to choose in which one you want to work, as all master data and processes belong exclusively to the selected Statement Cycle. When not using a multi-branch database, you only need to create one Statement Cycle per year and choose it just after the year starts. If using multi-branch, you will need to configure master data and perform absorption costing for each branch individually and choose the Statement Cycle corresponding to the branch in which you want to work.

Window bab_abrid_browse.psr

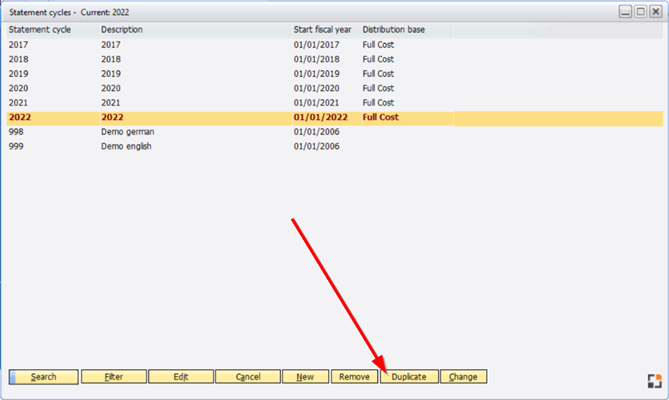

Important note: As Business Performance master data is related to Statement Cycles, whenever you create a new Statement Cycle by clicking on the “New” button, it will come empty. If you have already defined another Statement Cycle previously and just want to create a new period for it (maintaining the same master data), you can choose the previous Statement Cycle and click on the “Duplicate” button instead. This will duplicate all master data related to the Statement Cycle to create a new one.

Window bab_abrid_browse.psr

See other Beas settings for Absorption Costing

back to Absorption costing settings (SAP and Beas)