Usage is only possible if "Absorption Costing" for Business Performance is defined in the Beas Configuration wizard.

QUICK GUIDE FOR THE 2020.12 RELEASE OF ABSORPTION COSTING MODULE IN BEAS

![]()

Business performance - Introduction to Absorption costing

An Introduction to Absorption Costing

Absorption costing is a costing method targeted at distributing manufacturing overheads to the manufactured items and appropriating these costs into inventory, where they will remain until the company sells them. After selling, the products’ costs, now including manufacturing overheads distribution, will be recognized as COGS (Costs of Goods Sold) and affect the Profit & Losses financial statement. It is important to note that, apart from being an extremely useful tool for accurate per-product profits calculation, absorption costing is a mandatory requirement for publicly traded companies who need to follow GAAP and/or IFRS standards, and required by tax laws in the United States, Brazil, and many other countries.

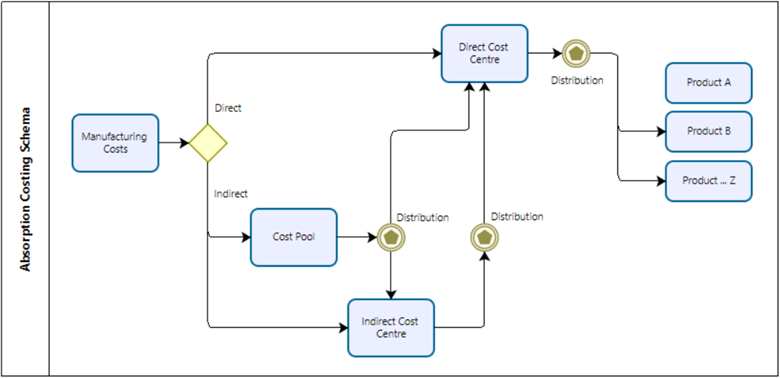

When using absorption costing, the companies book all their manufacturing costs to cost centers, which can be direct or indirect. Direct cost centers represent manufacturing units directly related to production, like production equipment and work centers. Indirect cost centers, on the other hand, can represent either manufacturing units indirectly related to production (such as maintenance, production supervision, and quality control) or cost pools, which are intermediate cost centers that collect multiple costs before a further distribution into other direct or indirect cost centers. Afterwards, distribution rules will set the basis for sharing the costs contained in indirect cost centers across the direct cost centers, which will later be carried over into the products.

However, absorption costing can be an extremely complicated and time-consuming task without a powerful and integrated ERP to support it. In fact, several companies give up on absorption costing or treat it just like a burdensome obligation due to the simple fact that they lack the proper tools to calculate it properly. After all, for absorption costing to be successful, it needs to combine information coming from finance, production, maintenance, and many other departments, which can all have their own systems and require extensive manual work to match an immense amount of data in spreadsheets and input the results into the ERP. Nevertheless, when using Beas Manufacturing, you can be just a few clicks away from accomplishing a full absorption costing process, as it integrates manufacturing data to financial information coming from SAP Business One, automatically calculates the distributions of costs in between cost centers and products, and reevaluate the goods based on their new calculated costs.

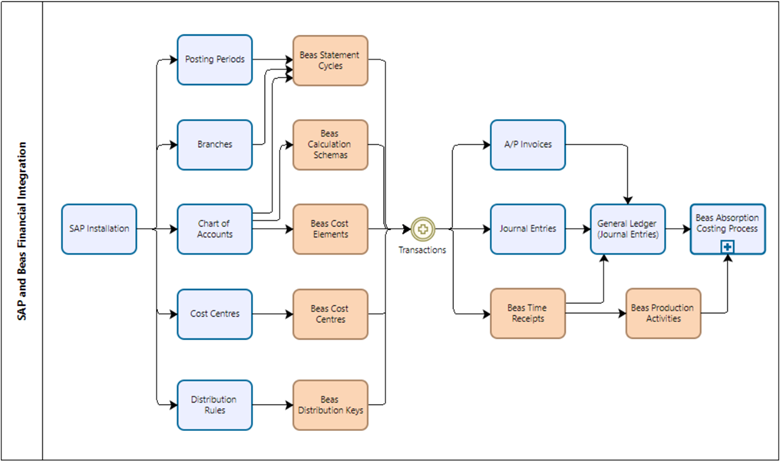

In an SAP Business One installation, the typical implementation process includes basic financial definitions such as posting periods, company branches (in the case of having multiple subsidiaries in the same database), chart of accounts, cost centers, and distribution rules (responsible for sharing values across multiple cost centers in certain transactions). Every time a user creates a transaction with inventory or financial implications, this transaction will trigger a journal entry containing manually selected accounts or automatically defined accounts based on accounting determinations, besides cost centers selected by the user or linked to the accounts. For using absorption costing in Beas Manufacturing, extra definitions are required, like statement cycles mapped to the branches and posting periods, cost elements associated to the desired accounts from the chart of accounts, cost centers for direct and indirect manufacturing costs, and distribution keys reflecting SAP’s distribution rules. The linking in between manufactured items and direct cost centers happens through time receipts, which are the transactions generated to record processing times from factory workers and machines, and will later compose the production activities, or the list of manufactured goods to receive absorption costing appropriation. Time receipts also trigger journal entries for labor and machine costs according to pre-defined resources and operators’ cost rates, in order to keep manufacturing costs as close as possible to the costs after absorption costing. These costs are automatically reverted as part of the absorption costing process (preventing double-costing on products, as they will receive labor, machine, and overhead costs from absorption costing) and, based on absorption costing results, output new recommended cost rates for production resources. The flowchart below illustrates the integrations between SAP Business One and Beas Manufacturing for generating transactions and processing absorption costing.

|

Beas Manufacturing, through its module Business Performance, provides an absorption costing functionality capable of distributing manufacturing costs (labor and overheads) to the produced goods, including distributions from cost pools and indirect cost centers to direct cost centers, detailed control of open absorption costing values for unfinished production orders at the month’s end, and redirection of sub-assemblies’ appropriations to the products who consumed then. Absorption costing affects inventory values, expenses, and costs of goods sold (if the products to reevaluate were already sold during the month) by moving production-related expenses into inventory. This means that, after executing absorption costing, the company’s profits will be higher unless it has sold all its produced inventory, as manufacturing costs are only recognized as expenses in the form of COGS. As mentioned before, absorption costing is a mandatory requirement for publicly traded companies who need to follow GAAP and/or IFRS standards, and required by tax laws in the United States, Brazil, and many other countries. By having Beas Manufacturing in place, your company can transform the burden of fulfilling tax requirements or complying to financial standards into a powerful and automated analytical tool for understanding costs and profits, requiring a fraction of the effort normally required by the traditional manual calculation methods. |

See:

Absorption Costing - Concept

Absorption Costing - Setup

Absorption Costing - WORKFLOW

Absorption Costing Report - Concept